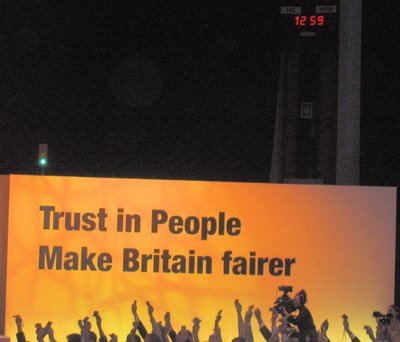

Mark the time well... The party just came of age.

Mark the time well... The party just came of age. All kudos to the Lib Dem Tax Commission for a hard job well done - and to the party leadership for putting their necks on the line.

Today's tax debate was what party conferences should be about. It was passionate, tense, good humoured, important and well argued.

And, most importantly - the right result.

PS: I see Mr Cameron's anaemic 'Built to Last' document has been endorsed by 60,000 Tory members (with 5,000 rejecting it - I assume they'd vote against motherhood and apple pie as well, if given the choice).

Some 175,000 Tory members failed to vote at all, suggesting there may be a slight lack of enthusiasm for Mr Cameron's brand of "inoffensive Conservatism".

I'll leave it to you to judge which of today's two results demonstrates real leadership.

8 comments:

I was wondering why the Lib Dems don't consider a revolutionary change to the present tax system.

Totally scrap Income Tax, VAT, Inheritance tax.... and moveover mostly to a money movement tax.

Insist that all banks in the UK install software systems that automatically deduct a percentage of each transaction that flows through their accounts. This would increase tax collection to near 100%. It would also mean that only the banks have to be audited to confirm correct collection.

It would also allow the lower income earners to be paid in cash thus remaining outside the taxation system.

I believe that there would be a lot of benefits to this though a significant disadvantage could be that less people would be needed in the tax offices.

As a response to Anonymous' comment one good reason for not doing that is that it would be near-impossible to predict future governmental income. Furthermore, in the case of a recession (when people tend to stop casually purchasing goods) government resources would fall making it harder for the government to do anything to reverse it.

Not to mention the complexity and the degree of tax avoidance that could occur, etc.

Movement of money is good - it's what stimulates the economy and growth. In fact, pretty much the best thing an individual can do for society is spend / give their money. Why would you want to discourage that with a tax?

Julian H

The blogosphere seems to have filled with radical supposed tax experts recently - has anyone else noticed?

I seem to remember that a similar tax system had been suggested by an eminent Economist ?

I'm not so sure that money movement would be that difficult to predecit going forward, Also largest movement of money I would have thought would be by business not individuals.

I have to admit though as is obvious I am no tax expert. Hoped there were some out there that could explain why it would not work.

Another thought is would a tax when money is spent stop people spending money if they no longer have income tax to pay ?

Would it turn us into a nation of savers and remove some of the burden of Pensions ?

Would we in fact suddenly have significant amounts of Capital to invest into UK companies and the stock market ?

Or perhaps we would not give up our spending habits and the change would have no effect on out lifestyle in teh same way that VAT changes from 15% to 17.5% did not seem to.

Australia

http://www.fairgotax.org/DTax_Intro.htm

Sounds like an internal version of the Tobin tax, which is controversial...

I don't see it working, and the side effects are complex and difficult to predict.

Post a Comment